2023 Litigation Finance Survey Report

Published by: Lake Whillans & Above The Law

Welcome to the 2023 Lake Whillans/Above the Law litigation finance survey report. Since 2017, we have invited in-house counsel and law firm attorneys to share their perspectives on third-party litigation funding as part of our effort to monitor developments in this rapidly evolving field.

Their feedback has highlighted the practice’s evolution from a little-known tool, used mostly by small companies in need of funding, into an integral part of the legal ecosystem, with benefits for organizations of all sizes. While litigation finance clearly remains a valuable resource for small and medium-sized businesses, we have also seen an uptick in the number of large law firms and big-name corporations who work with funders.

This year, more than half of the in-house counsel who reported having firsthand experience with litigation finance work in large companies or Fortune 1000 corporations. According to many attorneys surveyed, financing options have become a standard part of discussions with clients, who may be seeking to hedge the risk of litigation, fund legal fees, or cover operating expenses.

That more than 80% of those who have firsthand experience with litigation finance would not only work with third-party funders again but also recommend the option to others underscores the value of this practice in the litigation arsenal. As one survey respondent observed, litigation finance is “always a consideration for the right case.”

Highlights From This Year’s Survey:

- Of the attorneys who have firsthand experience working with a litigation finance firm, the vast majority (81%) said they would use litigation funding again, and an even higher percentage (85%) said they would recommend litigation finance to others. This satisfaction is consistent: the proportion of respondents who said they would use litigation finance again has remained above 80% for the last five years.

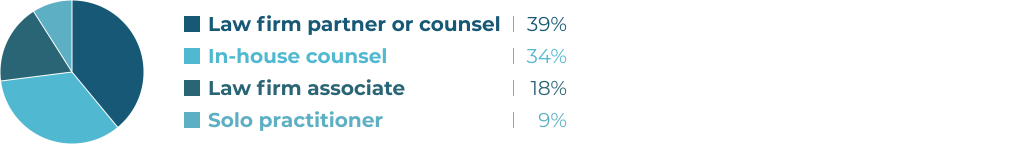

- The proportion of in-house counsel among the respondents with firsthand experience showed huge growth. In 2022, for example, 11% of those with firsthand experience were in-house attorneys; this year’s figure (34%) is more than three times as high.

- More than 60% of respondents reported that clients were the main drivers behind the decision to seek litigation financing, with the impetus coming more often from the business or operations side of the company than the legal department.

- According to 43% of in-house counsel, the strongest motivation for seeking litigation finance was to hedge the risk of litigation, while law firm partners more often cited lack of funds for legal fees or expenses as the primary reason.

- More than 40% of attorneys reported that their clients obtained funding at least in part to monetize a claim or judgment.

- Respondents have worked with third-party funders in a variety of matters, including business litigation, intellectual property cases, mass torts, and antitrust litigation. Domestic business litigators make up the largest subset of respondents.

- The kinds of clients interested in litigation finance range widely, from individuals and small private companies to large public corporations and venture-backed start-ups.

Read on for our full findings.

Survey Demographics:

314 respondents

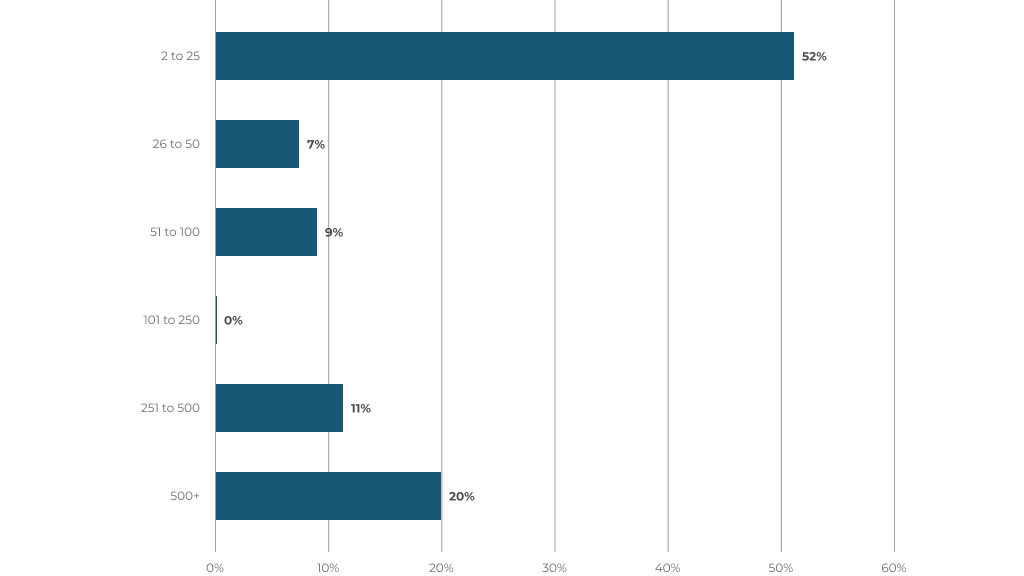

Company Size

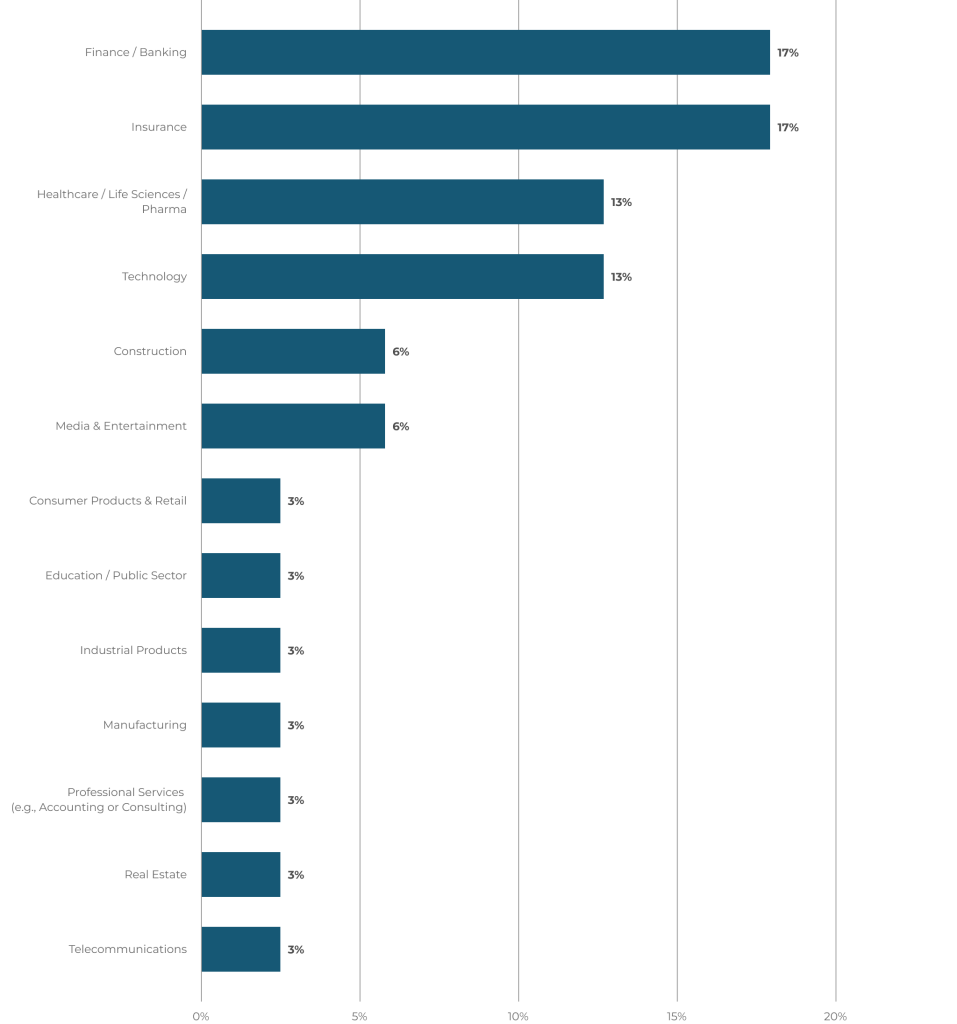

Primary Industries Represented

Multiple selections allowed

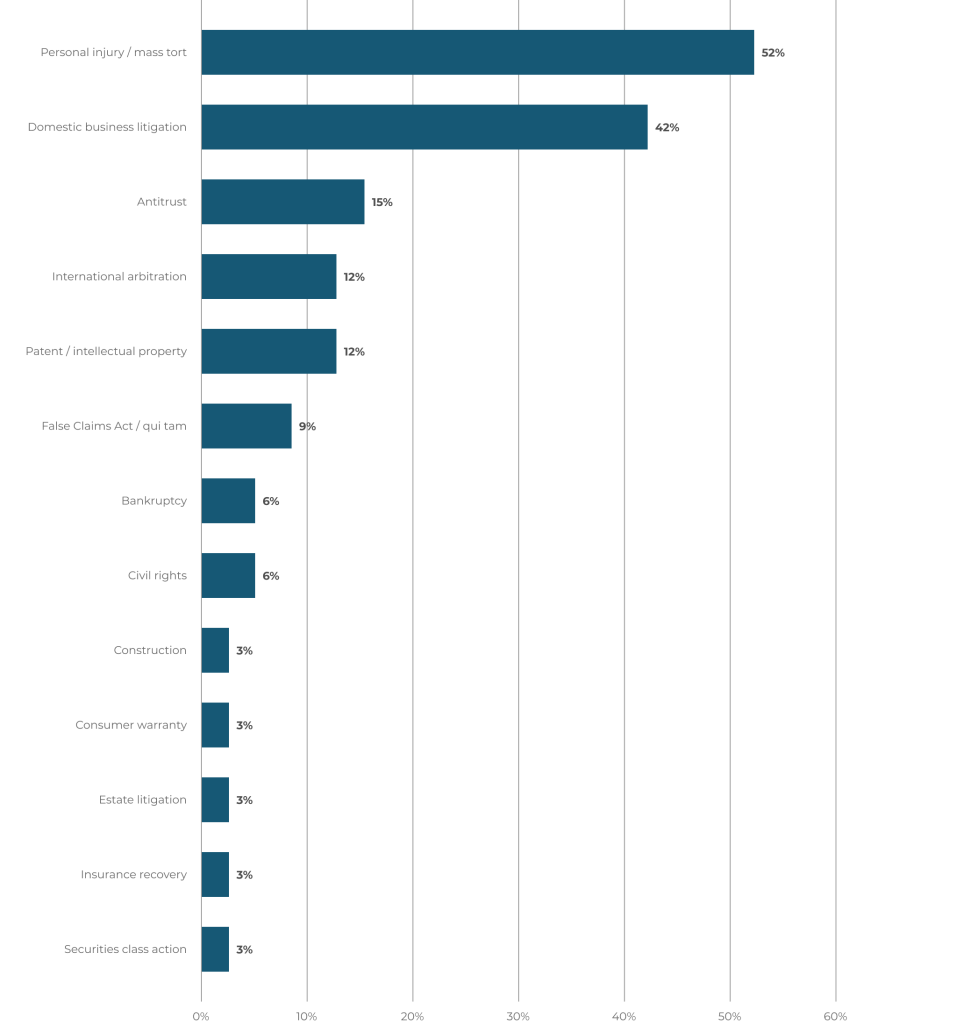

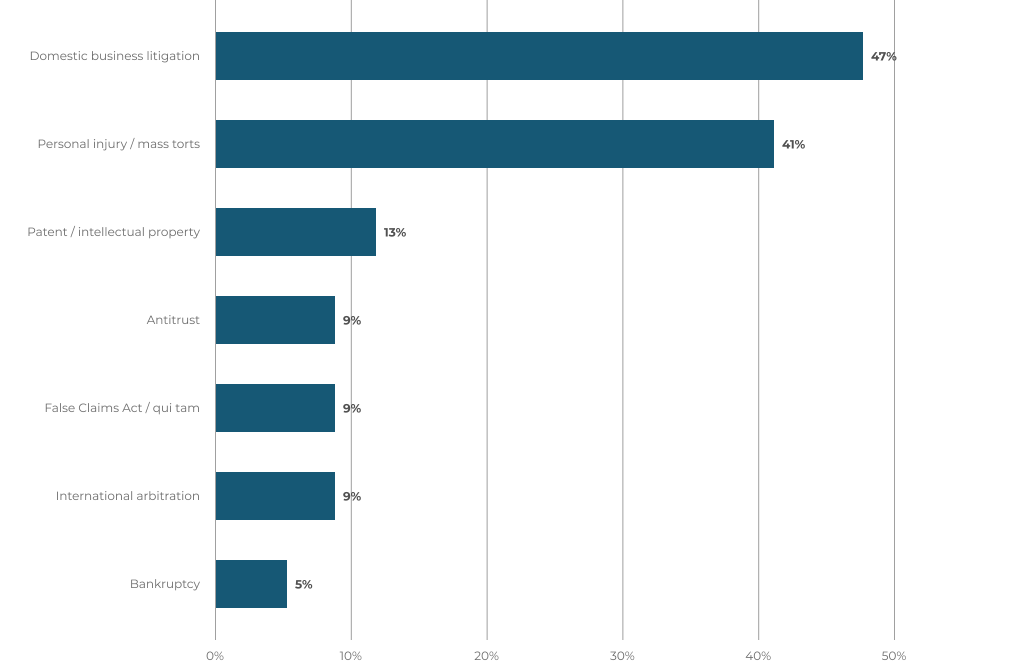

Primary Areas of Litigation Represented

Multiple selections allowed

Two-thirds of respondents identified litigation as their practice area; corporate and insurance practices account for much of the remainder. Among the litigators, they practice in the following areas.

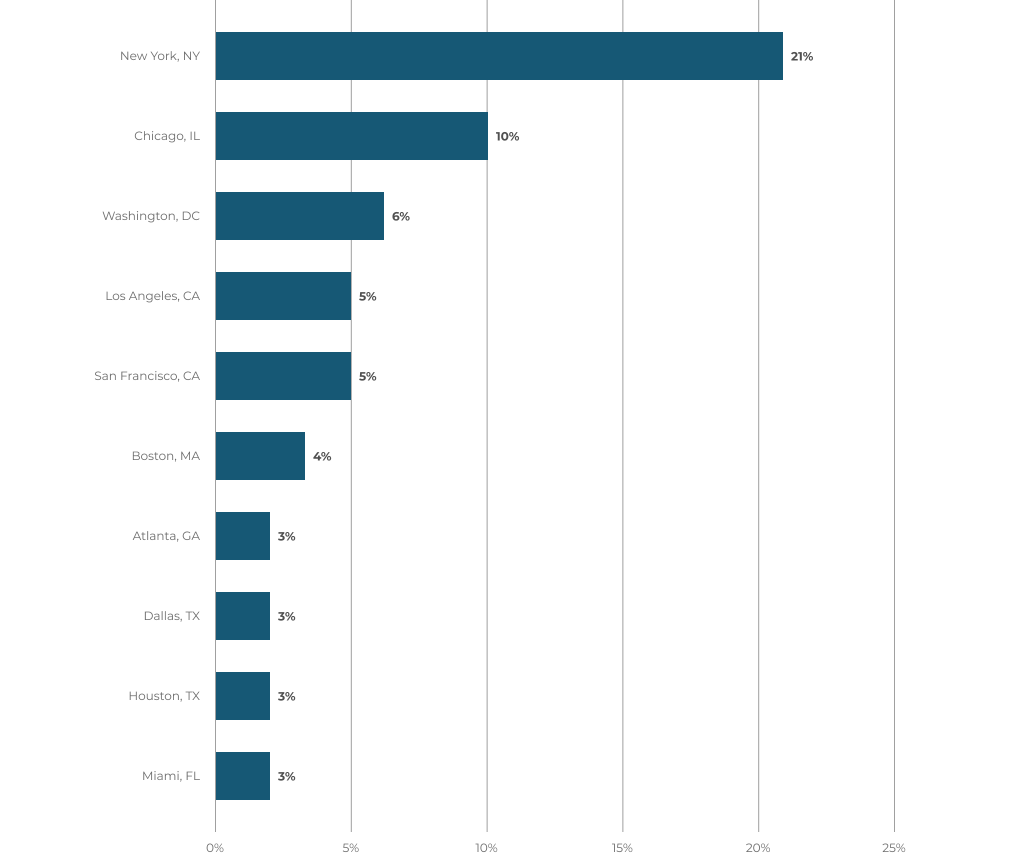

50+ Cities Represented

Question Breakdown:

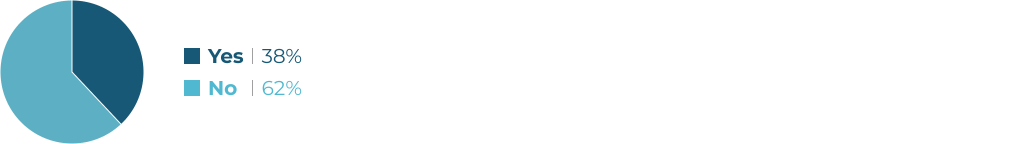

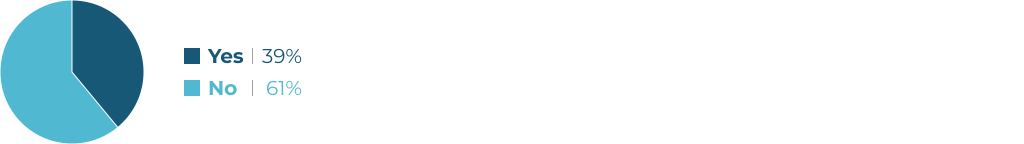

Do you have firsthand experience working with a litigation finance firm?

Almost 40% of respondents reported having firsthand experience working with a litigation finance firm.

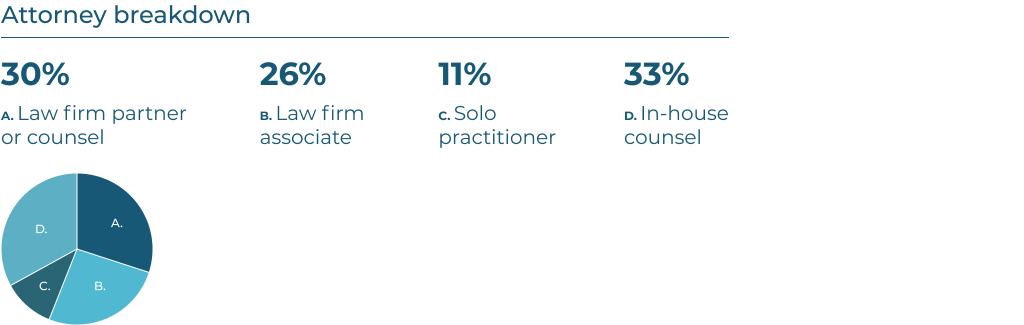

Firsthand Experience by Role

Among the respondents with firsthand experience, the largest group are law firm partners (39%), followed by in-house counsel (34%). Law firm associates represent 18%, and solo practitioners represent 9%. In-house counsel represent a larger share of the respondents with firsthand experience than they did in the past. In 2022, for example, 11% of those with firsthand experience were in-house attorneys; this year’s figure is more than three times as high.

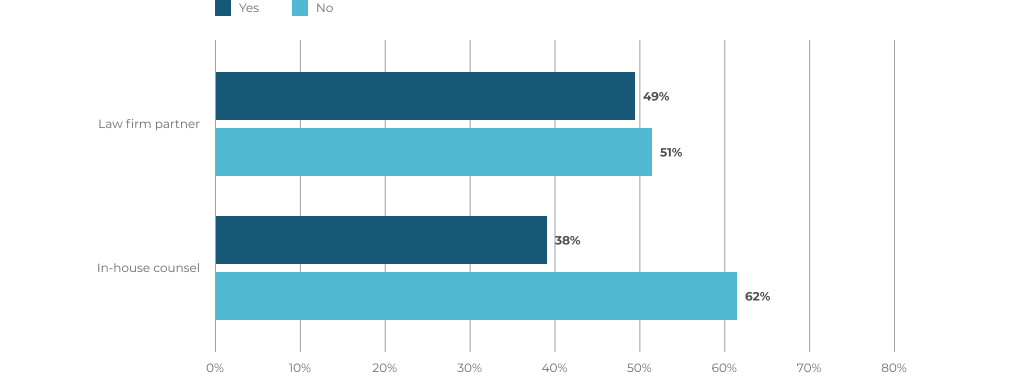

Firsthand experience among partners compared to in-house counsel

Comparing relative experience among law firm partners versus in-house counsel, the proportion of attorneys with firsthand experience is higher among partners.

Firsthand Experience by Firm Size

While many of the attorneys who have firsthand experience with litigation finance are at small law firms, almost a third (31%) work in firms with more than 250 lawyers and 20% are at firms with more than 500 lawyers.

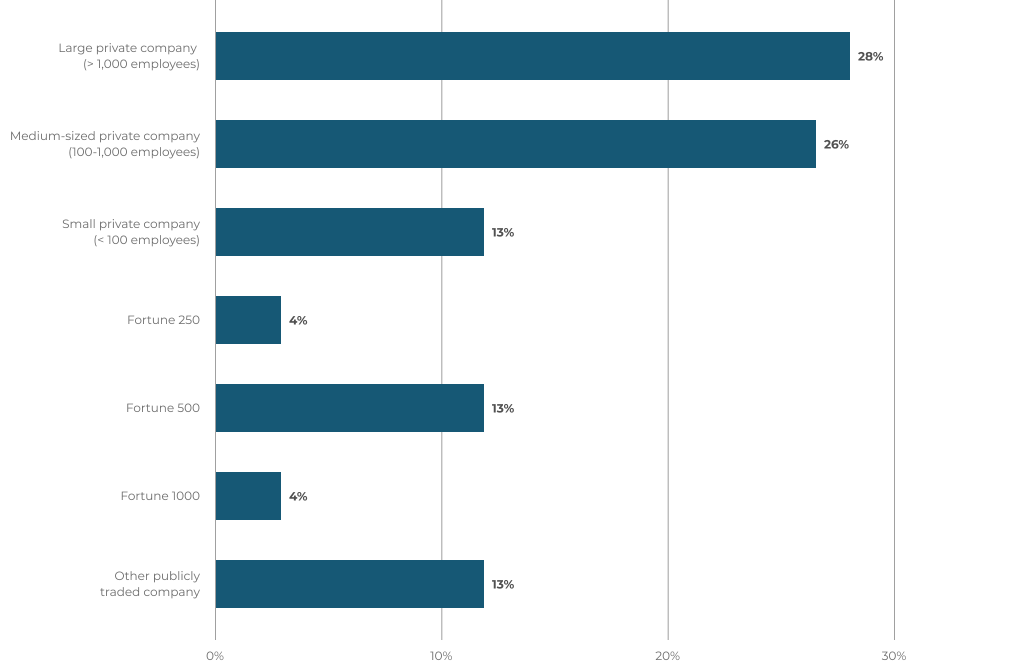

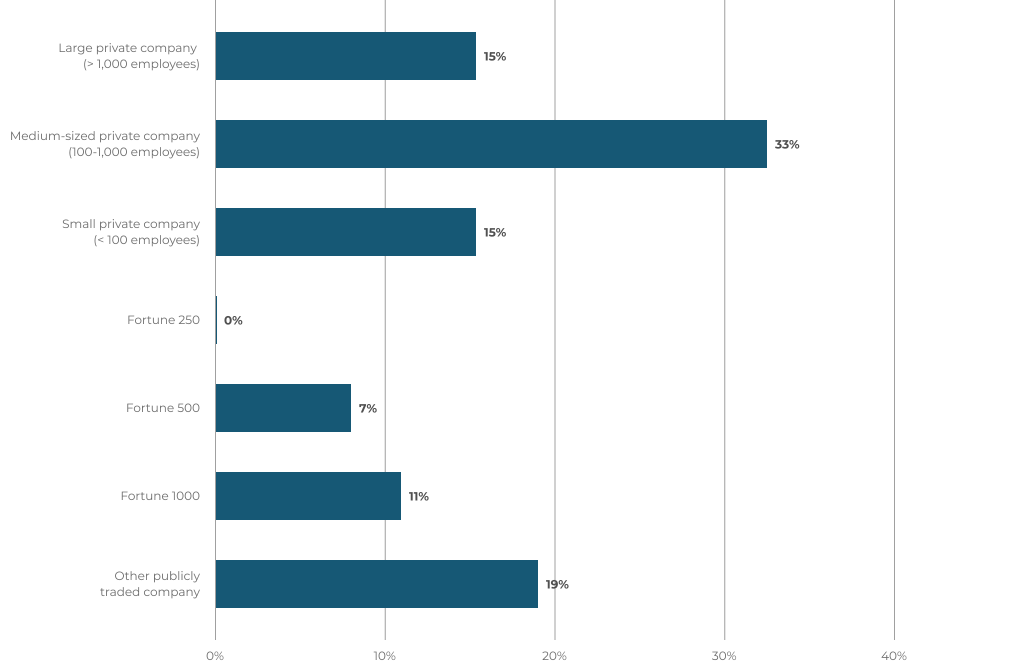

Firsthand Experience by Company Size

Just as third-party funding isn’t limited to law firms of particular size, it is also a tool employed by clients of varying size. The in-house lawyers who reported having firsthand experience with litigation finance work in organizations ranging from small private companies with less than 100 employees to large publicly traded companies and Fortune 1000 enterprises.

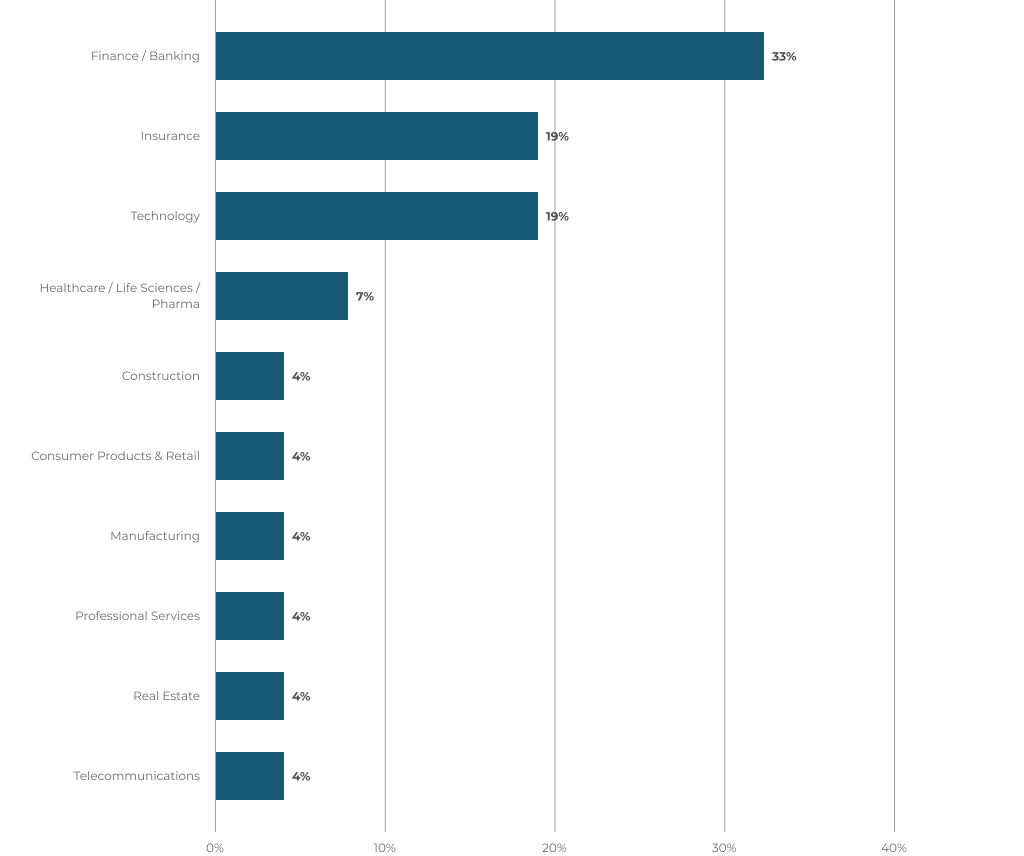

Firsthand Experience by Industry

One-third of the in-house counsel who reported having firsthand experience work in the finance sector. Other industries represented include insurance, technology, and healthcare/life sciences.

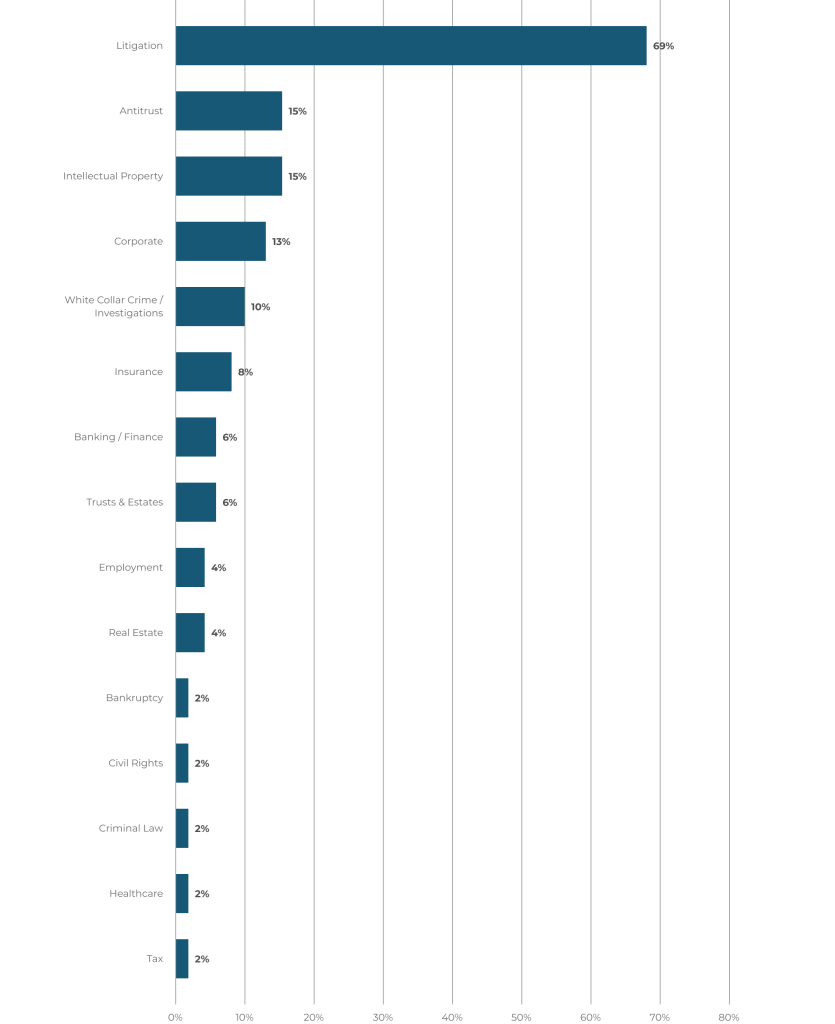

Firsthand Experience by Respondent’s Practice Area

Unsurprisingly, litigation is the primary practice area for most (69%) of the law firm attorneys who have firsthand experience with litigation finance.

Firsthand Experience by Litigation Specialty

More than half of the litigators with firsthand experience specialize in personal injury law and mass torts, and 42% focus on business litigation. Some of the other areas of focus include antitrust, international arbitration, intellectual property, and False Claims Act or qui tam cases.

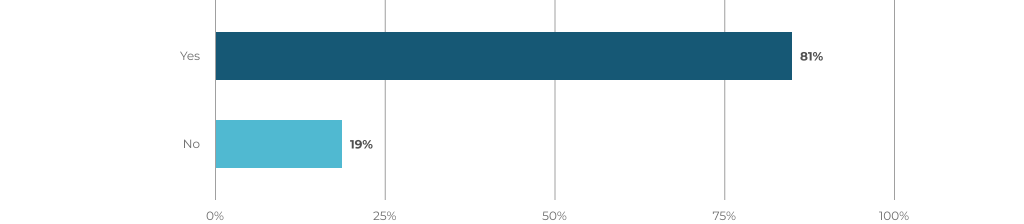

Would you use litigation finance again?

Asked of those with firsthand experience

A majority (81%) of the respondents who have worked with litigation funders said they would use litigation finance again. Satisfaction with their experience has been consistent across surveys, as the proportion of respondents who said they would use litigation finance again has remained above 80% for the last five years.

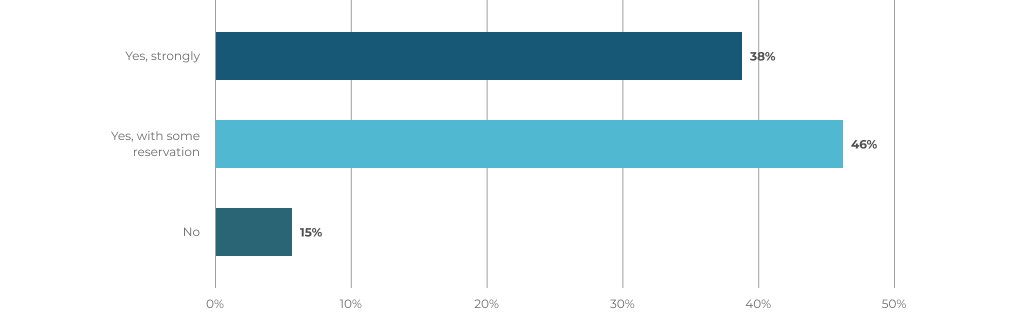

Would you recommend litigation finance to others?

Asked of those with firsthand experience

Similarly, most respondents (85%) said they would recommend litigation finance to others. This figure has exceeded 80% every year since 2020.

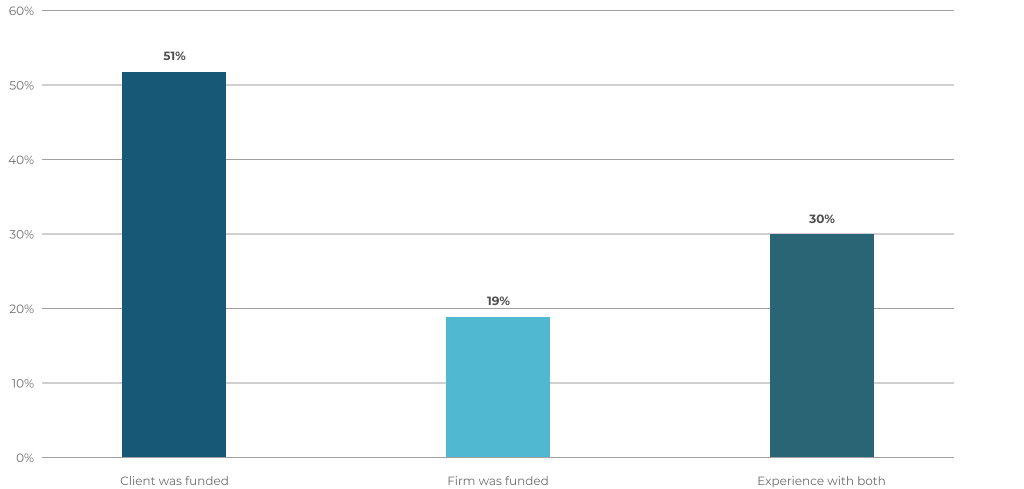

In your experience with litigation finance, was your firm funded or were you representing a funded client?

Asked of law firm attorneys and solo practitioners with firsthand experience

Third-party funding can involve either client financing or law firm financing, and our survey respondents reported experience with both kinds of funding. Of the attorneys who work in law firms or solo practices, just over half said that they represented a funded client, almost 20% said that their firm was funded, and 30% said they have experience with both situations.

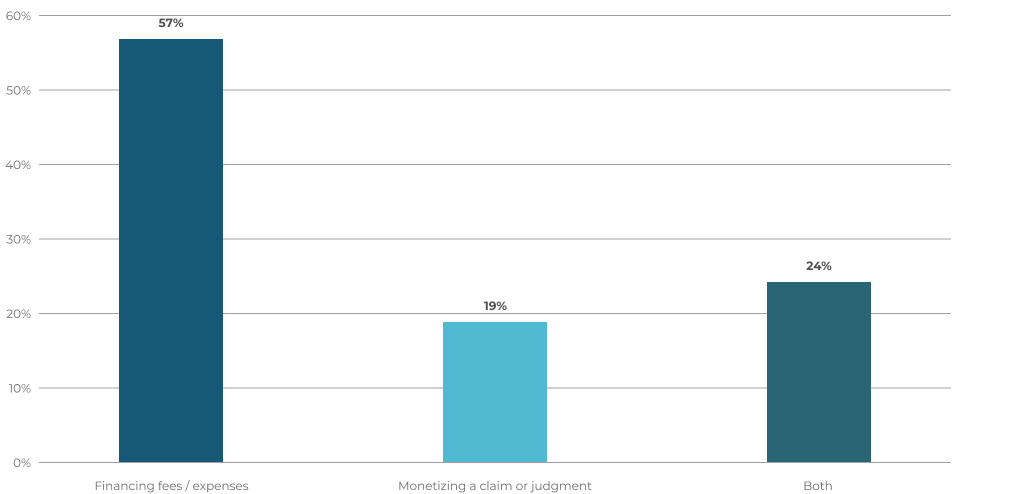

For the client-funded matter, did the client obtain litigation funding for:

With respect to client-funded matters, respondents reported that most clients (57%) obtained funding in order to finance legal fees or expenses. In a smaller number of cases (19%), the funding was to monetize a claim or judgment. Nearly one-fourth of attorneys said the funding served both purposes.

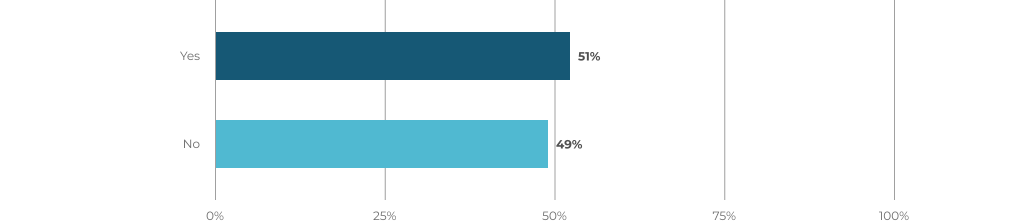

For the client-funded matter, did your firm also take on some risk as part of its fee arrangement? (i.e., discounted fees in exchange for contingent share of the upside)

Approximately half (51%) of attorneys reported that their firm took on some risk as part of the fee arrangement in cases involving client-funded matters.

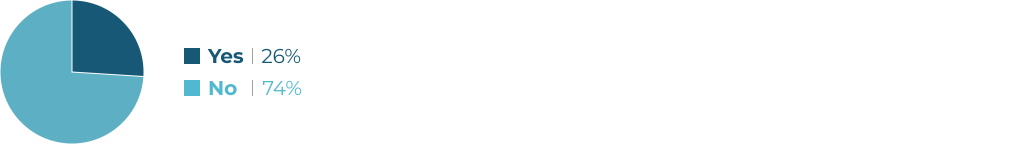

Does anyone in your firm or company have experience working with a litigation finance firm?

Asked of respondents without firsthand experience themselves

Among those respondents without firsthand experience, 26% said that others at their organization do have experience with litigation funding.

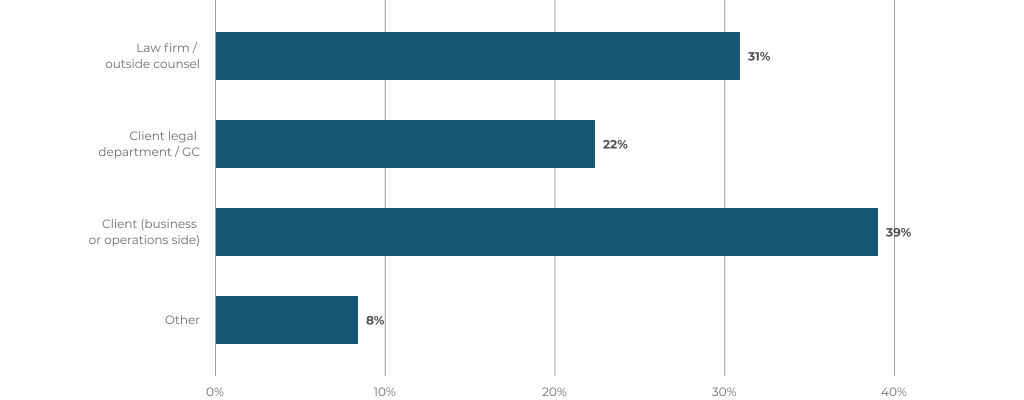

Who was the main driver of the decision to seek litigation financing?

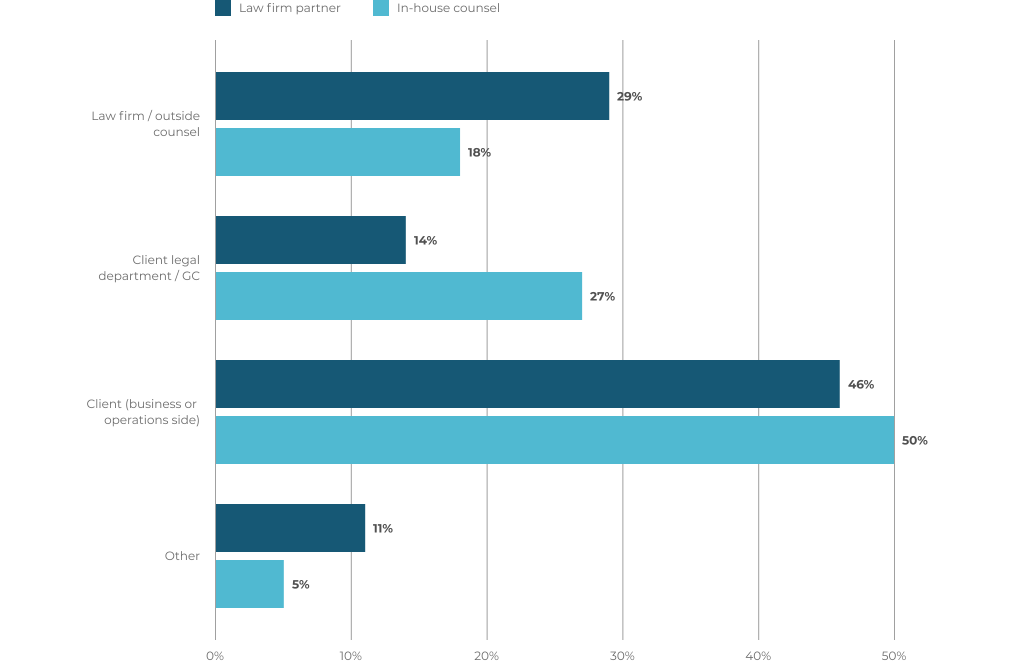

More than 60% of respondents reported that clients were the main drivers behind the decision to seek litigation financing — and primarily the business or operations side rather than the legal department. Law firms were the primary drivers, according to 31% of respondents.

Other drivers include:

- Individual client

Main drivers, according to law firm partners compared with in-house counsel

According to both law firm partners and in-house attorneys, the decision to seek third-party funding was most frequently attributable to the client’s business side. But the two groups’ perceptions differ as to the role of the legal department and outside counsel. In-house counsel were nearly twice as likely as partners to see their department as the main driver (27% vs 14%), while partners were more likely than in-house attorneys to report that their firms were the primary force behind the decision (29% vs 18%). It seems that both in-house attorneys and law firm partners are taking credit for ideating litigation finance, which may be telling of positive outcomes or experiences.

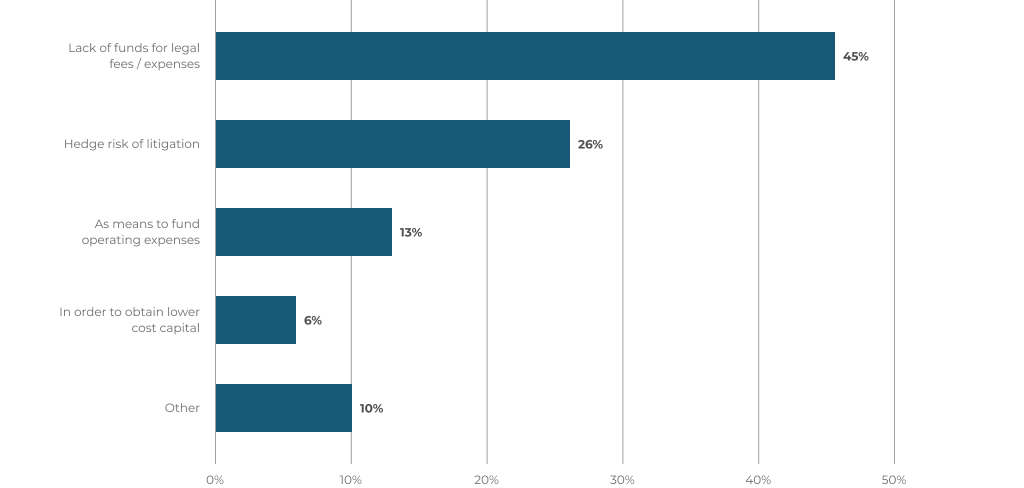

What was the strongest motivation for seeking litigation finance?

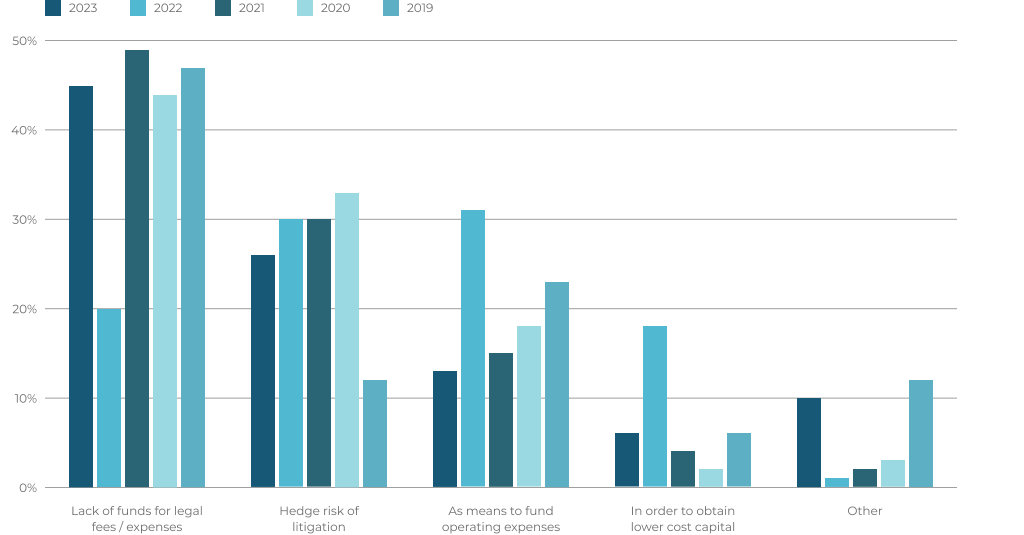

The most common reasons for seeking litigation finance include lack of funds for legal fees or expenses (45%) and to hedge the risk of litigation (26%). These figures are in line with most previous surveys, although in 2022 funding operating expenses was cited as the primary motivation more often than lack of funds for legal fees.

Other motivations include:

- Balance of all [factors]; most important factor is presence of a valuable claim

- Client needed money

- Client personal expenses

- Foreign actions where contingency fees not allowed

- Medical bills, loss of work adding up

Strongest motivations over the last five years

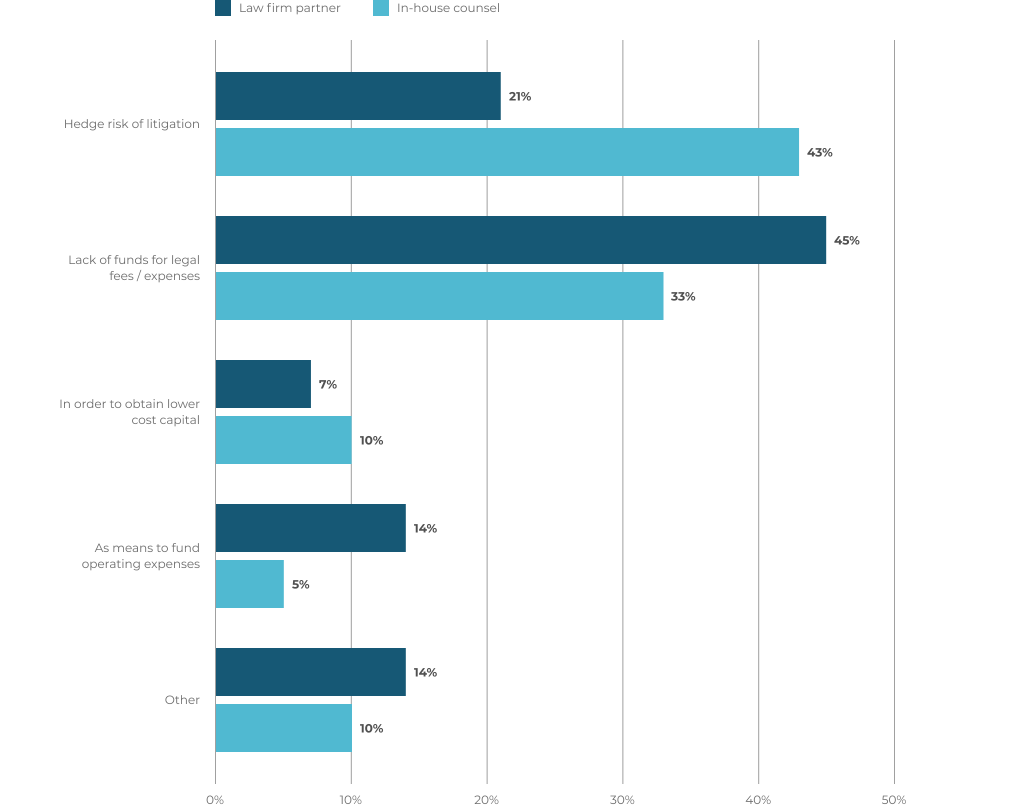

Strongest motivations, according to law firm partners compared to in-house counsel

The different perspectives of law firms and clients are evident when comparing the responses from in-house counsel to those of partners. More than 40% of in-house attorneys said that hedging the risk of litigation was the strongest reason for obtaining financing, compared to 21% of law firm partners. Partners more frequently cited lack of funds for legal fees or expenses (45%).

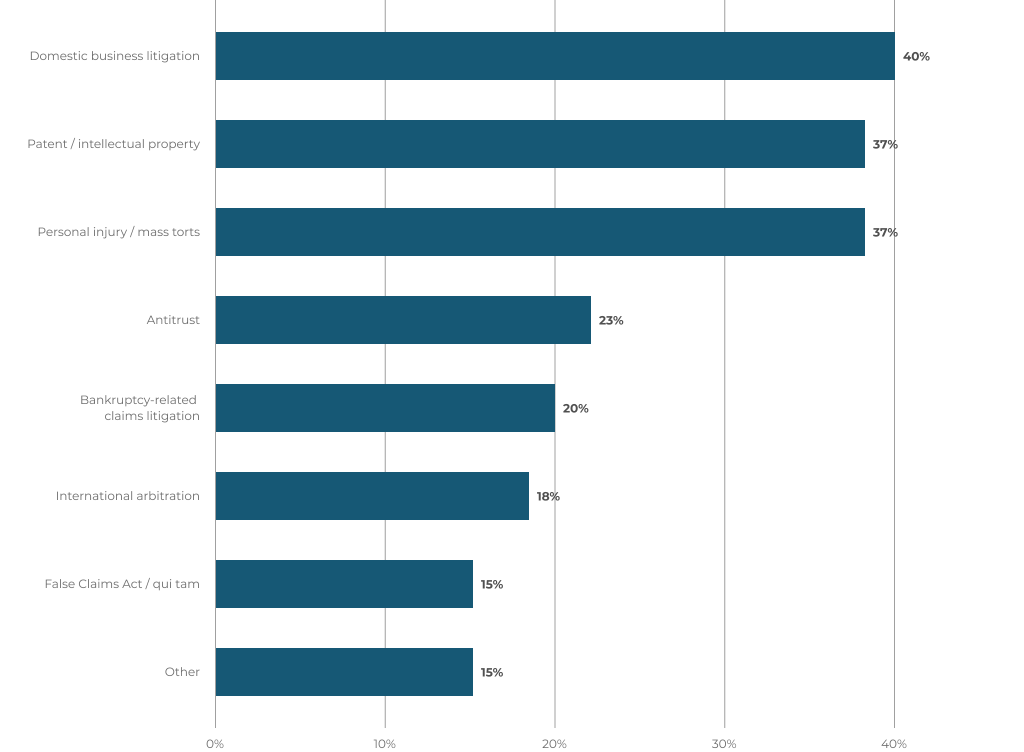

What kinds of cases have been funded?

Multiple selections allowed

Third-party finance has funded a broad range of matters among survey respondents. Some of the most common include domestic business litigation, intellectual property cases, and mass torts. Other kinds of cases cited by attorneys involve antitrust, bankruptcy-related claims, international arbitration, and qui tam suits.

Other kinds of cases include:

- Civil rights

- Construction

- Employment

- Insurance recovery

- International business litigation

- Real estate

- Securities

- Tax protest

- Wrongful death

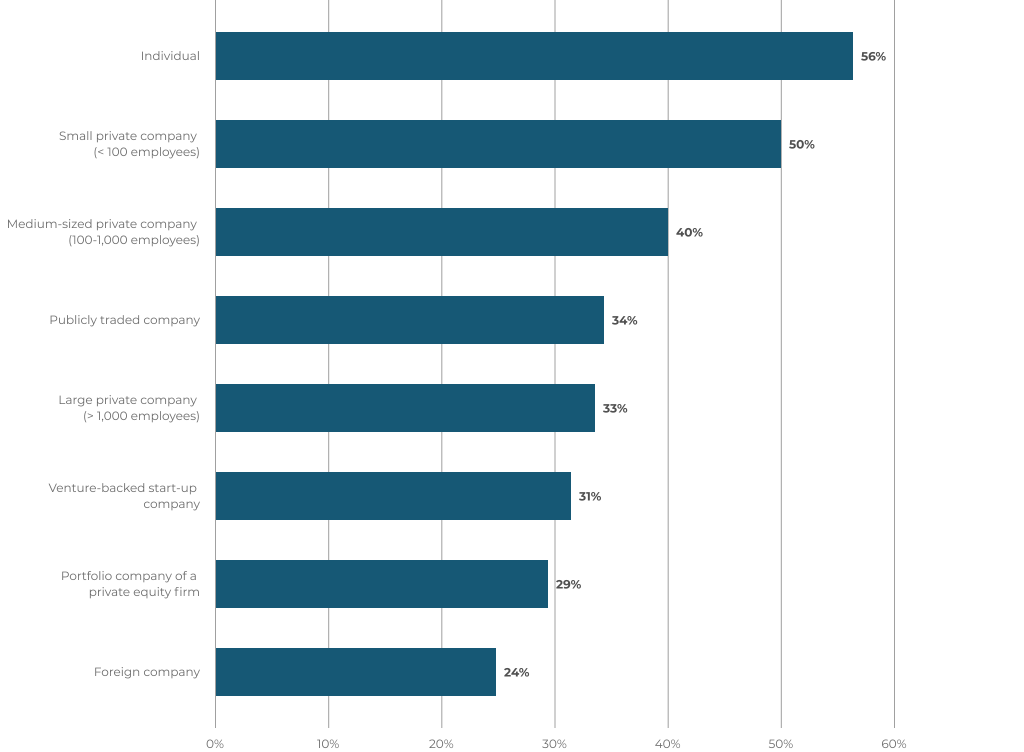

In your experience, what types of clients seek litigation finance?

Multiple selections allowed

There isn’t one type of client that is most likely to seek litigation funding, according to the attorneys surveyed. Interest in litigation finance can come not only from individuals and small private companies, but also from large private or publicly traded companies, venture-backed start-ups, portfolio companies of private equity firms, and foreign businesses.

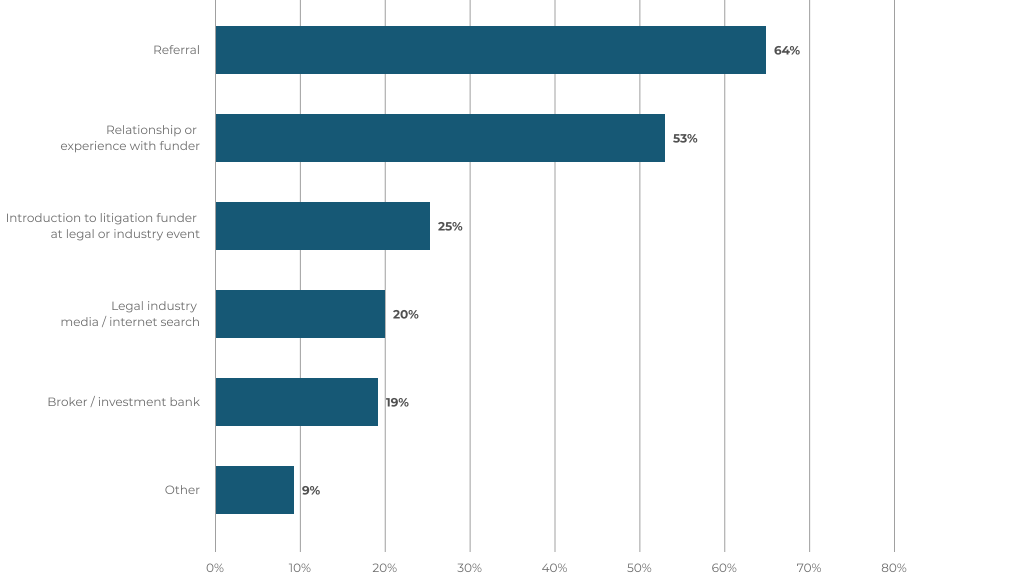

How were potential litigation finance providers identified?

Multiple selections allowed

Referrals and prior experience with a funder were the most common sources of information about litigation finance providers among those surveyed. Other methods for identifying potential funders included introductions at industry events, internet searches, and through a broker or investment bank.

Other means of identifying litigation funders include:

- Client found

- Cold call from funder

- Email from funder

- Law firm

- Litigation discovery

- Social circle

What are the most important considerations in choosing a litigation financier?

Respondents were asked to assign an ordinal value (1 being highest, 8 being lowest) to a set of factors. Overall, the survey respondents ranked these factors in the following order of relative importance:

1. Economic terms (2.04)

2. Financier’s right to influence / decide strategy or settlement (3.91)

3. Flexibility regarding the structuring of financing arrangements (4.08)

4. Financier’s reputation / track-record (4.74)

5. Subject-matter or industry-specific expertise( 5.21)

6. Speed / responsiveness (5.47)

7. Your own prior relationship with funder (6.44)

8. Firm/company’s relationship with funder (6.55)

9. Other terms (6.57)

Law firm partners and in-house counsel alike most frequently identified economic terms as the foremost consideration when choosing a litigation funder.

Law Firm Partner

1. Economic terms (1.63)

2. Flexibility regarding the structuring of financing arrangements (3.79)

3. Financier’s right to influence / decide strategy or settlement (4.00)

4. Financier’s reputation / track-record (5.00)

5. Speed / responsiveness (5.31)

6. Subject-matter or industry-specific expertise of funder (5.92)

7. Other terms (6.15)

8. Your own prior relationship with funder (6.27)

9. Firm / company’s relationship with funder (6.94)

In-House Counsel

1. Economic terms (1.85)

2. Flexibility regarding the structuring of financing arrangements (3.79)

3. Financier’s right to influence / decide strategy or settlement (4.00)

4. Subject-matter or industry-specific expertise of funder (4.49)

5. Financier’s reputation / track-record (4.60)

6. Speed / responsiveness (5.74)

7. Firm / company’s relationship with funder (6.26)

8. Other terms (7.11)

9. Your own prior relationship with funder (7.17)

Both groups also gave similar weight to the flexibility of the financing structure and the financier’s right to influence the strategy or settlement. Compared to law firm partners, however, in-house counsel put more emphasis on the provider’s expertise and track record, while their speed and responsiveness were ranked more highly by partners.

Has litigation finance become more relevant to your practice in the last year?

Nearly 40% of respondents said that litigation finance has become more relevant to their practice in the last year.

The respondents were asked to elaborate on how litigation finance has become more relevant to their practice. The following includes a representative sample of their comments:

“Increasingly standard practice over the last 5-10 years.”

“It is now part of most case discussions.”

“The cost and uncertainty has continued to rise exponentially, and litigation financing manages the risk and shares the costs.”

“More plaintiff side cases leads to more finance needs.”

“More clients come asking about the options to finance.”

“Plaintiffs need it to level the playing field. Too many potential clients forgo litigation because it costs too much up front.”

“It has underwritten our firm financing.”

“There is a great need for experts in more cases, which gets very expensive very fast.”

“It has enabled our firm and our clients to press forward in litigation where we otherwise might have settled at a significant discount.”

“Always a consideration for the right case.”

Note: These final two survey questions concern the perceptions and opinions of that portion of our respondent pool WITHOUT firsthand experience of litigation finance.

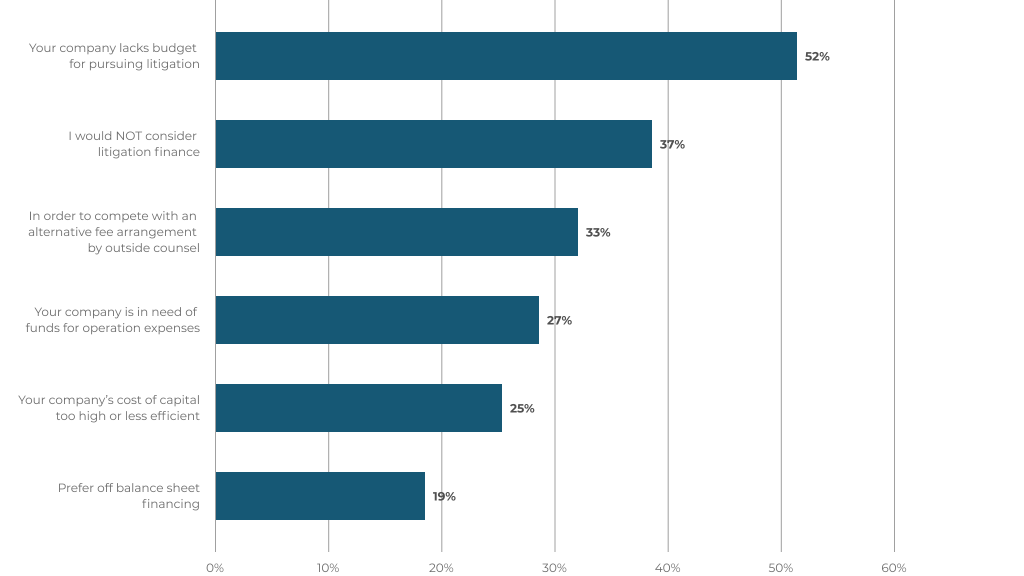

Would you consider exploring litigation finance in any of the following circumstances?

Asked of in-house counsel without any firsthand experience with litigation finance (multiple selections allowed)

While some in-house counsel who haven’t had direct experience with litigation funding said they would not consider it, a majority said they would explore it in certain circumstances, most commonly if their company lacked the budget to pursue litigation.

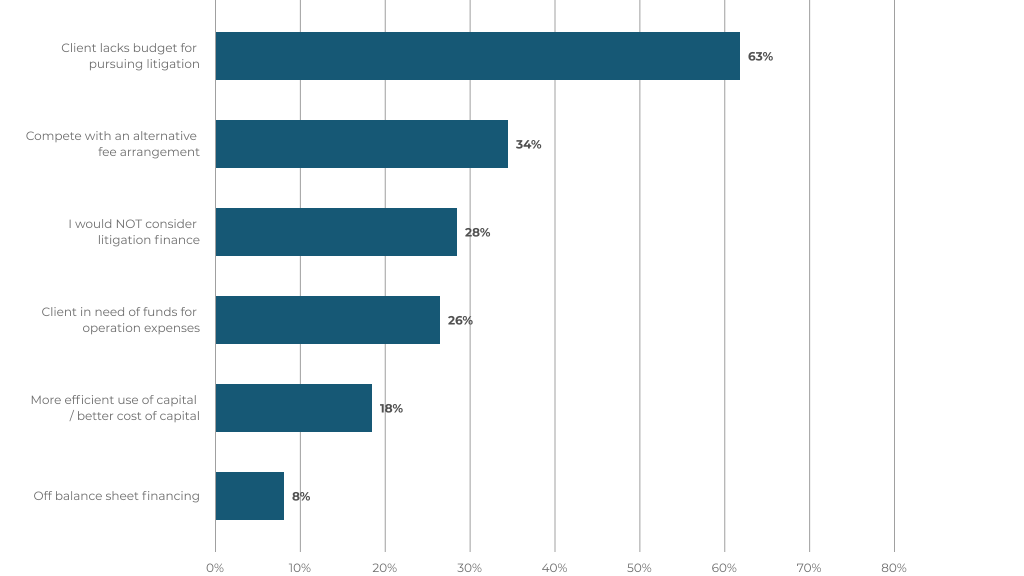

Would you consider exploring litigation finance in any of the following circumstances?

Asked of solo practitioners and law firm attorneys without any firsthand experience with litigation finance (multiple selections allowed)

Of the law firm attorneys and solo practitioners without prior experience of third-party funding, 63% said they would consider it when a client lacks the budget to pursue litigation. Other circumstances in which they might explore litigation finance include to compete with an alternative fee arrangement, when the client needs funds for operating expenses, or for more efficient use of capital.