2020 Litigation Finance Survey Report

Published by: Lake Whillans & Above The Law

Since publishing our inaugural litigation finance survey in 2017, each subsequent iteration has been a story of ever-increasing traction for the practice of third-party funding. Our 2020 findings continue this narrative, and show a marked increase in the scale and momentum of the field’s development and acceptance. Perhaps the most striking finding in this year’s survey was a nearly 30% year-to-year increase in the percentage of respondents reporting that they had firsthand experience with litigation finance.

Other highlights include:

- Lawyers in every single industry we examined saw a significant uptick (at least 10%) in firsthand experience with litigation finance.

- Nearly 100% (99.36%) of respondents with firsthand experience with litigation finance agreed that they would use litigation finance again.

- The proportion of respondents who would not consider litigation finance has plummeted since the 2019 survey.

- Roughly three-quarters of our respondents stated that litigation finance has become more relevant to their practice in the last year.

We note that our survey data was collected before the COVID-19 crisis and the financial turmoil it has caused. These findings demonstrate that litigation finance is well poised to meet the challenges companies and law firms are now facing. Claim monetization, financing of claimholders, and capital for law firms are core offerings of a litigation financier like Lake Whillans, and are likely to become even more attractive solutions to many more companies and firms as we move through 2020 and beyond. We expect that next year’s survey results will show marked differences as litigation finance further penetrates every segment of the market driven by new necessities and creative problem solving.

Read on for our full findings.

Respondent Breakdown:

Question Breakdown:

Do you have firsthand experience working with a litigation finance firm?

The majority of respondents, 69.79%, indicated that they do have firsthand experience working with a litigation finance firm. This is a substantial jump from last year, where only 41.07% reported having firsthand experience working with litigation finance firms.

Firsthand Experience By Firm Size

The largest proportion of firsthand experience was reported by attorneys at firms with 51-100 employees

The smallest proportion of firsthand experience was reported by attorneys at firms with 500+ employees

This is a shift from last year’s findings – in last year’s findings, the largest proportion of firsthand experience was reported by attorneys in the smallest (non-solo) cohort of firms (2-25 attorneys). Given this trend, we expect significant growth this year among lawyers in the largest law firms.

Firsthand Experience By Industry

Those in the telecommunications industry reported the most firsthand experience.

Those in the finance/banking industry reported the least firsthand experience.

According to last year’s results, the Energy and Telecom industries reported the most firsthand experience, at 52.6% and 50.5%. While both maintained majority proportions of firsthand experience reports, both saw large spikes in this year’s findings.

Compared to our 2019 findings, practitioners in every single industry saw a significant uptick (at least 10%) in firsthand experience.

Would you use litigation finance again?

Asked of those with firsthand experience

Nearly 100% (99.36%) of all survey respondents reported that they would use litigation finance again. This is a substantial spike from last year, where, while still a comfortable majority, a “mere” 81.43% of respondents reported they would use litigation finance again.

Would you recommend litigation finance to others?

Asked of those with firsthand experience

Less than one percent of respondents reported that they would not recommend litigation finance to others. The majority of respondents (66.67%) stated that they would strongly recommend litigation finance to others. 32.70% stated that they would recommend litigation finance with “some reservation.”

Does anyone in your firm or company have experience working with a litigation finance firm?

Asked of respondents without firsthand experience themselves

Over 60% of those respondents without firsthand experience reported that others at their organization have had experience working with a litigation finance firm. This represents a THREEFOLD increase over last year’s findings.

Who was the main driver of the decision to seek litigation financing?

In-house counsel

Law firm partner

In-house attorneys reported that general counsel/legal departments (i.e. themselves and their peers) drove the decision about 40% of the time. Law firm partners reported that outside counsel (i.e. themselves and their peers) drove the decision about 40% of the time.

This is in line with this year’s overall findings, showing it really depends on who you ask – everyone tends to think they are in the driver’s seat.

“Other” drivers included:

“We wouldn’t have taken the case without funding of expenses, and client needed help to provide funding”

“Combination of client (business side) and law firm”

“Offering contingency or mixed-contingency options for large commercial litigations”

“Efficiency”

What was the strongest motivation for seeking litigation finance?

Overall, lack of funds for legal fees/expenses was the strongest motivation for seeking litigation finance.

For in-house counsel, the strongest reported motivation was a tie between lack of funds and hedging risk of litigation (37.5%). This has shifted slightly from last year, where in-house counsel were primarily concerned with hedging risk (43%).

Law firm partners were primarily concerned with lack of funds (48.33%). This is on par with last year’s results, but with a minor increase. Hedging risk was the secondary motivation for law firm partners, at 33.33% (consistent with last year’s 35%).

In your experience, what types of clients seek litigation finance?

Multiple selections allowed

Small private companies (62.31%), individuals (48.74%), and medium sized companies (39.2%) were identified as the top three categories of clients that seek litigation finance.

How were potential litigation finance providers identified?

Multiple selections allowed

Potential litigation finance providers were primarily identified through relationships or experiences with the funder (64.33%) or referral (63.74%).

“Other” means included “Reputation” and “Marketing”

What are the most important considerations in choosing a litigation financier?

Respondents were asked to assign an ordinal value (1 being highest, 8 being lowest) to a set of factors. Overall, respondents ranked the factors in the following order of decreasing importance:

1. Economic terms (2.12)

2. Flexibility regarding the structuring of financing arrangements (3.82)

3. Financier’s right to influence/decide strategy or settlement (4.43)

4. Financier’s reputation/track-record (4.52)

5. Speed/responsiveness (4.74)

6. Your own prior relationship with funder (5.21)

7. Subject-matter or industry-specific expertise (5.27)

8. Firm/company’s relationship with funder (5.87)

In-house

1. Economic terms (2.88)

2. Flexibility regarding the structuring of financing arrangements (3.79)

3. Financier’s right to influence/decide strategy or settlement (4.72)

4. Financier’s reputation/track-record (3.84)

5. Speed/responsiveness (4.32)

6. Your own prior relationship with funder (5.4)

7. Subject-matter or industry-specific expertise (4.04)

8. Firm/company’s relationship with funder (6.32)

Partners

1. Economic terms (1.81)

2. Flexibility regarding the structuring of financing arrangements (3.74)

3. Financier’s right to influence/decide strategy or settlement (4.55)

4. Financier’s reputation/track-record (4.66)

5. Speed/responsiveness (4.9)

6. Your own prior relationship with funder (4.95)

7. Subject-matter or industry-specific expertise (5.8)

8. Firm/company’s relationship with funder (5.58)

Partners and in-house counsel agree on the primacy of economic terms, and both weigh it more heavily than in previous surveys above other factors, but among partners, this factor was ascribed greater relative importance. In-house counsel valued subject-matter or industry-specific expertise and speed and responsiveness more than law firm partners, whereas law firm partners placed greater importance on flexibility in transaction structure.

Has litigation finance become more relevant to your practice in the last year?

74.59% of respondents stated that litigation finance has become more relevant to their practice in the last year.

Selected comments on “how litigation finance has become more relevant to your practice:

“The increased cost of litigation has made it difficult to prosecute/defend merited cases without financing for many cases. It also presents the opportunity to isolate risk for clients.”

“Clients seem more open to financing, and financiers seem more aware of the need for transparency.”

“Clients’ interest is at an all-time high.”

“I have had 3 separate clients ask about it before even thinking of filing a complaint.”

“More clients are receptive to the idea of funded litigation. There is also a greater number of funders than in prior years looking to partner with law firms on a variety of fee arrangements, not pure contingency.”

“If you are not familiar with it, you are behind the eight ball in terms of business development. Also, more people on the other side are using it, and thus discovery efforts relating to lit finance have become important.”

“It is part of the calculus for every litigation matter, at least on the plaintiff side.”

“We see it as a business solution.”

“It is a fantastic way of mitigating risk and taking liability off balance sheet.”

Respondents with No Firsthand Experience with Litigation Finance

Only about 30% of all survey respondents did not have firsthand experience with litigation finance. The balance of our survey findings below concern the perceptions and opinions of that minority of our respondent pool WITHOUT firsthand experience with litigation finance.

Would you consider exploring litigation finance in any of the following circumstances?

Asked of partners, solos, and associates without any firsthand experience with litigation finance (Multiple selections permitted)

While budget limitations remain the leading reason to consider litigation finance, there has been a marked increase towards seeking other benefits of litigation finance, including raising capital for operating expenses (up 40%) and allowing law firms to compete with alternative fee arrangements by offering a similar economic deal for a claimholder using litigation funding (up 22%). The proportion of respondents who would not consider litigation finance dropped significantly since the 2019 survey, from about 30% to 9.59%.

Would you consider exploring litigation finance in any of the following circumstances?

Asked of in-house counsel without any firsthand experience with litigation finance (Multiple selections permitted)

The majority of in-house counsel without firsthand experience reported that they would consider litigation finance if their company lacked the budget for pursuing litigation (88.46%).

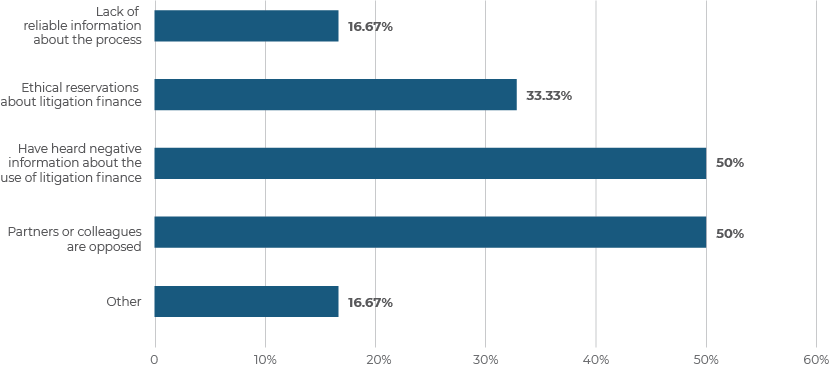

Why would you not consider using or recommending litigation?

Asked of the less than 10% of respondents who stated they would not consider litigation finance (Multiple selections permitted)

The most commonly cited reasons for ruling out the possibility of litigation finance, each by 50% of negative respondents, were having “heard negative information about the use of litigation finance” and “partners or colleagues being opposed.” This is a notable shift from last year, where the most common reason was cited as “ethical reservations.” This dropped by almost ten percent.

If you have a potential client with a meritorious claim, but who cannot pay your fees, would you consider any of these alternative structures?

Asked of those who said they would not consider litigation finance. (multiple selections permitted)

The most commonly cited alternative structure that respondents said they would consider was contingency or success fees (83.33%). This was followed by reduced hourly fee (66.67%)